When are the Eurozone final CPIs and how could they affect EUR/USD?

Eurozone final CPIs estimate overview

Eurostat will publish the Eurozone's inflation final estimate for April at 0900GMT today. Consumer prices are seen at 1.2% on a yearly basis, confirming the flash estimate. While the core figures are expected to arrive at 0.7% same as that reported in the first readout.

On a monthly basis, the CPI figure for April is seen sharply lower at 0.3% versus 1.0% previous while the core CPI is also expected to come in softer at 0.2% versus 1.4% last.

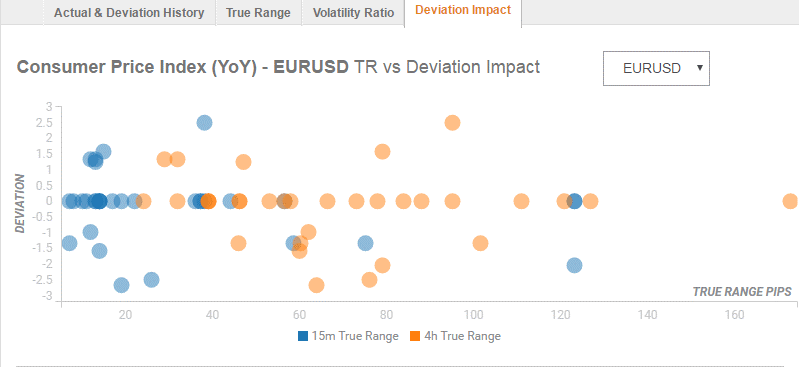

Deviation impact on EUR/USD

Readers can find FX Street's proprietary deviation impact map of the event below. As observed the reaction is likely to remain confined between 10 and 40 pips in deviations up to 1.5 to -3, although in some cases, if notable enough, a deviation can fuel movements of up to 50 pips.

How could affect EUR/USD?

Karen Jones, Analyst at Commerzbank explains, “EUR/USD executed a 23.6% retracement (1.1995) and has failed ahead of the 200-day moving average at 1.2021. Attention has reverted to the 1.1823/17 recent low and the low charted 22nd December. A close below here will target 1.1717/12, the 1.1616 May 2016 high and then the 1.1553 November low.

The 200-day ma guards the 1.2092 September 2017 high and the 1.2155 March low and while capped here we maintain an immediate bearish bias.”

Key Notes

European FX Outlook: Eurozone inflation set to stagnate in April as ECB says goodbye to outgoing vice-president Constâncio

EUR/USD Forecast: bearish pressure remains unabated ahead of EZ CPI/Draghi

About Eurozone final CPIs estimate

The Euro Zone CPI released by the Eurostat captures the changes in the price of goods and services. The CPI is a significant way to measure changes in purchasing trends and inflation in the Euro Zone. Generally, a high reading anticipates a hawkish attitude which will be positive (or bullish) for the EUR, while a low reading is seen as negative (or bearish).