Back

26 Oct 2020

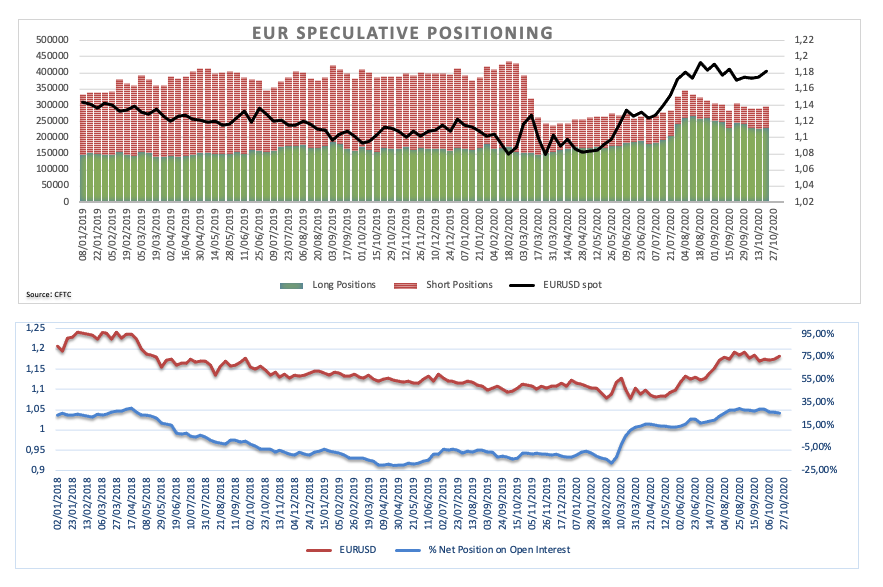

CFTC Positioning Report: EUR net longs dropped to multi-month lows

These are the main highlights of the CFTC Positioning Report for the week ended on October 20th:

- Speculators trimmed their net longs in the euro to levels last seen in late July on the back of increasing concerns regarding the advance of the coronavirus pandemic and its impact in the Old Continent.

- The dollar returned to the negative territory during last week following rising market chatter regarding a potential extra stimulus package. A “blue wave” win at the November elections is expected to drag DXY lower and sponsor fresh gross shorts in the buck.

- Net longs in crude oil rose to levels last recorded in late August on the back of rising hopes of fresh US stimulus and the probability that the OPEC+ could delay its plans to increase oil output in 2021. In the meantime, prices of the barrel of WTI are expected to keep the rangebound theme around the $40.00 mark at least until past the presidential elections.