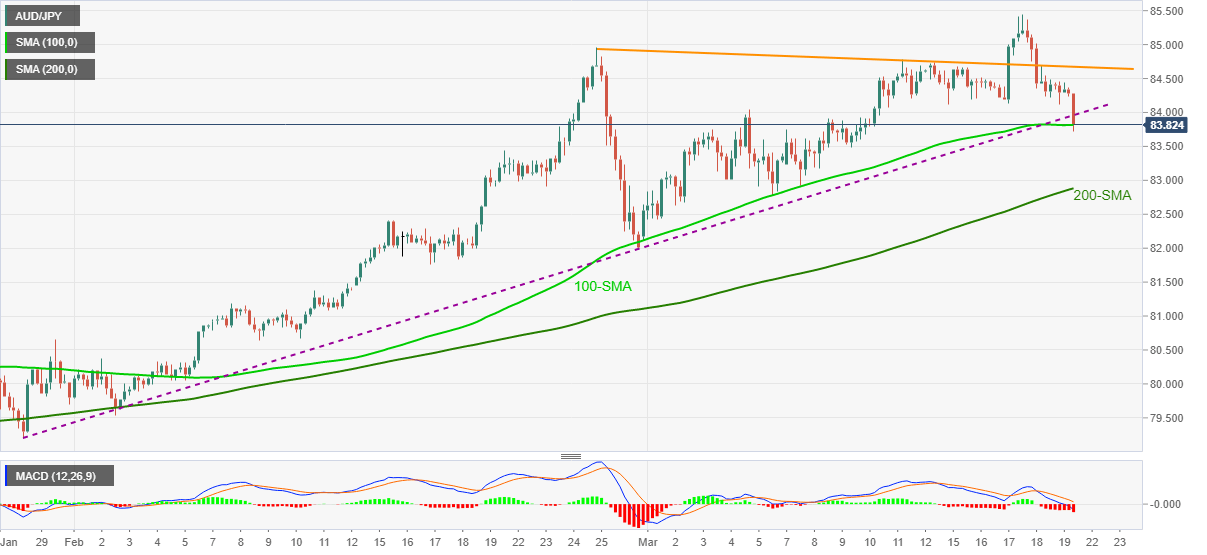

AUD/JPY Price Analysis: 100-SMA tests sellers cheering seven-week-old support break

- AUD/JPY struggles to fill the downside gap at the weekly open.

- Bearish MACD, clear break of the key trend line support, now resistance, direct sellers toward 200-SMA.

- Bulls need to cross 84.70 to retake the controls.

AUD/JPY consolidates recent losses around 83.85 following its drop to the two-week low at the week’s start. In doing so, the quote manages to bounce off 100-SMA but keeps a downside break of an ascending trend line from January 28.

Considering the bearish MACD and sustained break of the previous key support, AUD/JPY bears are likely rolling up their sleeves for further downside.

As a result, the pair’s further downside towards the 83.00 round-figure can’t be ruled out whereas the 200-SMA level of 82.88 may challenge AUD/JPY sellers afterward.

Meanwhile, an upside break of the immediate resistance line, previous support, around 84.00, requires decisive trading beyond one-month-old falling trend line hurdle, at 84.70 now, to restore bulls’ confidence.

Overall, AUD/JPY looks set to trim early 2021 gains unless the pair defies the latest trend line breakdown.

AUD/JPY four-hour chart

Trend: Further weakness expected